tax on venmo money

The 19 trillion stimulus package was signed into law in March. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

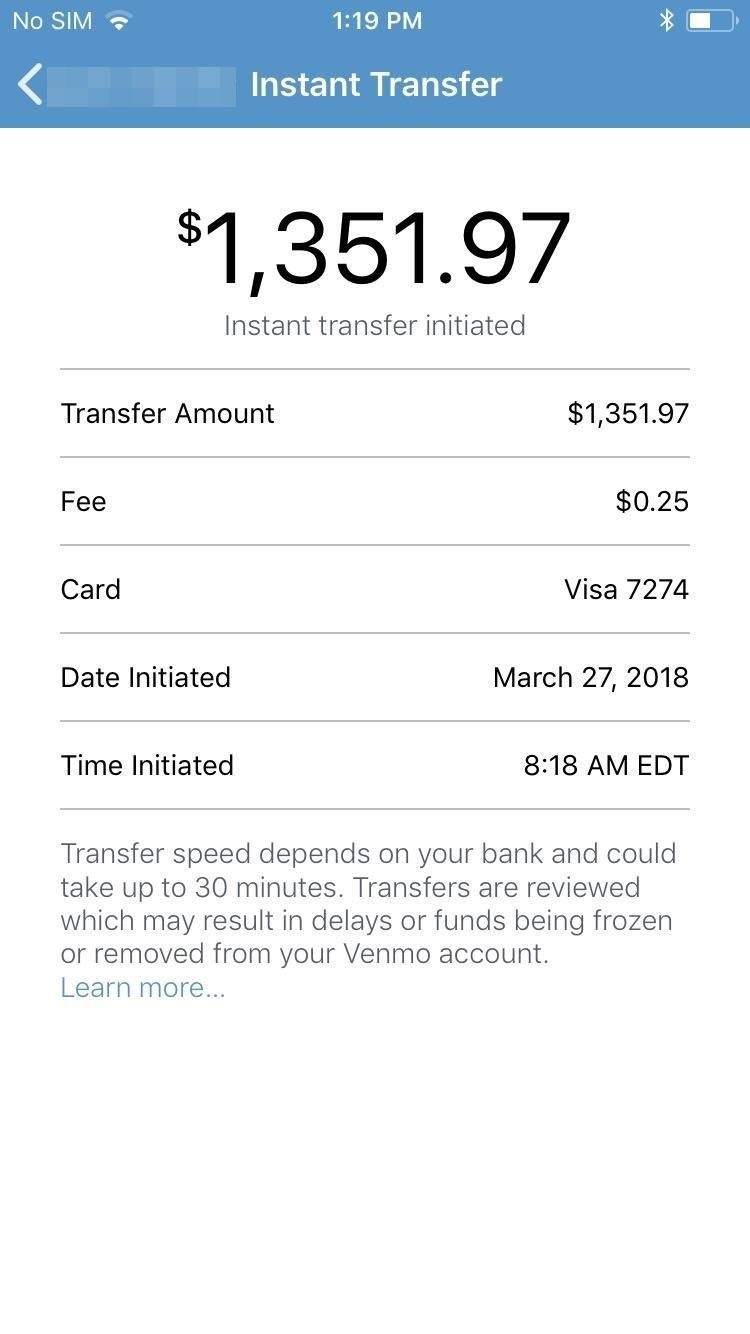

Venmo 101 The Fees Limits Fine Print You Need To Know About Smartphones Gadget Hacks

Will Venmo have new taxes in 2022.

. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business payments of 600 or more to the IRS through a 1099-K form. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. If you need help to manage your Venmo 1099 expenses and taxes try Bonsai Tax.

If youre the recipient youre typically not subject to gift tax. The annual gift-tax exclusion for 2021 is 15000 per donor per recipient meaning you dont need to pay taxes on a gift given that equaled 15000 or less. Now that a new IRS.

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. 9 2022 117 PM PT. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

PayPal does not allow trading if you are not verified. What to Expect for Tax Season. I need to update my name on Venmo for tax purposes.

Once verified you can trade up to 60000 limited to. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Citizen making money from the sale of goods or services the IRS considers it taxable income regardless of.

Get the scoop on Venmo and your taxes in 2022. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Learn more about what tax documents you can expect from Venmo.

Tax Holds for Businesses and Sellers. The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year. Send and receive money with Venmo friends and express yourself in each payment note.

Settle up with Venmo friends for any shared activity from road trips to picnics to takeout. The new rule is a result of the American Rescue Plan. After account verification this limit may increase up to 4999.

Now in addition to freelancers and others who receive payments. Individuals who have sold cryptocurrency on Venmo during the 2021 tax year will receive a Gains and Losses Statement irrespective of their state of residence. As for shipping limits in the case of Venmo the limit is set at 299.

Under the IRS new rules the online payment giants such as Venmo PayPal and Cash App were told to report commercial transactions of 600 or higher starting January 1. Taxes for Cryptocurrency on Venmo. If money was received as a gift you may need to explain the relationship between you and the person who gave you the present.

The new IRS rules stem from the American Rescue Plan Act. Heres who will have to pay taxes on. Millions of small business owners in.

Well explain how to handle Venmo transactions and the taxes you need to be aware of. Adding money to your Venmo account via cash-a-check feature faster check deposits all other accepted check types 500 with the minimum being 5 USD and no fee if your check cant be added Fees for sending and receiving money. Our software will scan your bankcredit card receipts to discover tax write-offs automatically.

For most states the threshold is 20000 USD in gross payment volume from sales of goods or. Utilities rent groceries when youre splitting basic bills everyone pays up easily. They became effective on January 1 of this year but their reporting requirements will begin with your 2022 tax return.

In this guide well be exploring Venmo 1099 taxes. Get smarter about your money and career with our weekly. While Venmo is required to send this form to qualifying users its worth.

This new tax rule only applies to payments for goods and. A new law requires third-party payment networks like Venmo and CashApp to report commercial payments of more than 600 a year. Requesting Updates to Your Tax Forms.

Please contact our Support team for assistance updating your name. Jan 7 2022 416 PM EST. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS.

If Your Annual Commercial Transactions Via Apps Like Venmo Exceed 600 You May Owe Taxes Next April. If youre a US. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business.

Here are the details debunked.

Cash App Vs Venmo How They Compare Gobankingrates

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

How To Make A Fake Walmart Receipt Expressexpense How To Make Receiptsexpressexpense How To Make Receipts Walmart Receipt Receipt Template Receipt

Should You Use Venmo Zelle Or Cash App Everything You Need To Know About The Hottest Mobile Payment Apps Mobile Payments Venmo Financial Tips

As Payments Go Social With Venmo They Re Changing Personal Relationships Npr

How To Add Money To Venmo From Bank Account Or Debit Card Credit Prepaid Card Youtube

The Taxman Cometh The Irs Wants In On Your Venmo

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

Cryptocurrency And Taxes What You Need To Know In 2021 Cryptocurrency Debt Solutions Bitcoin

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube In 2022 Tax Rules Tax Paypal

Venmo Co Founded By Penn Alums Andrew Kortina And Iqram Magdon Ismail Venmo Samsung Galaxy Phone Make Easy Money

Orderly Accounting By Katie Small Business Bookkeeping Business Money Business Finance Management

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

9 Venmo Settings You Should Change Right Now To Protect Your Privacy Cnet

8 Ways Venmo Makes Money Seeking Alpha

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech